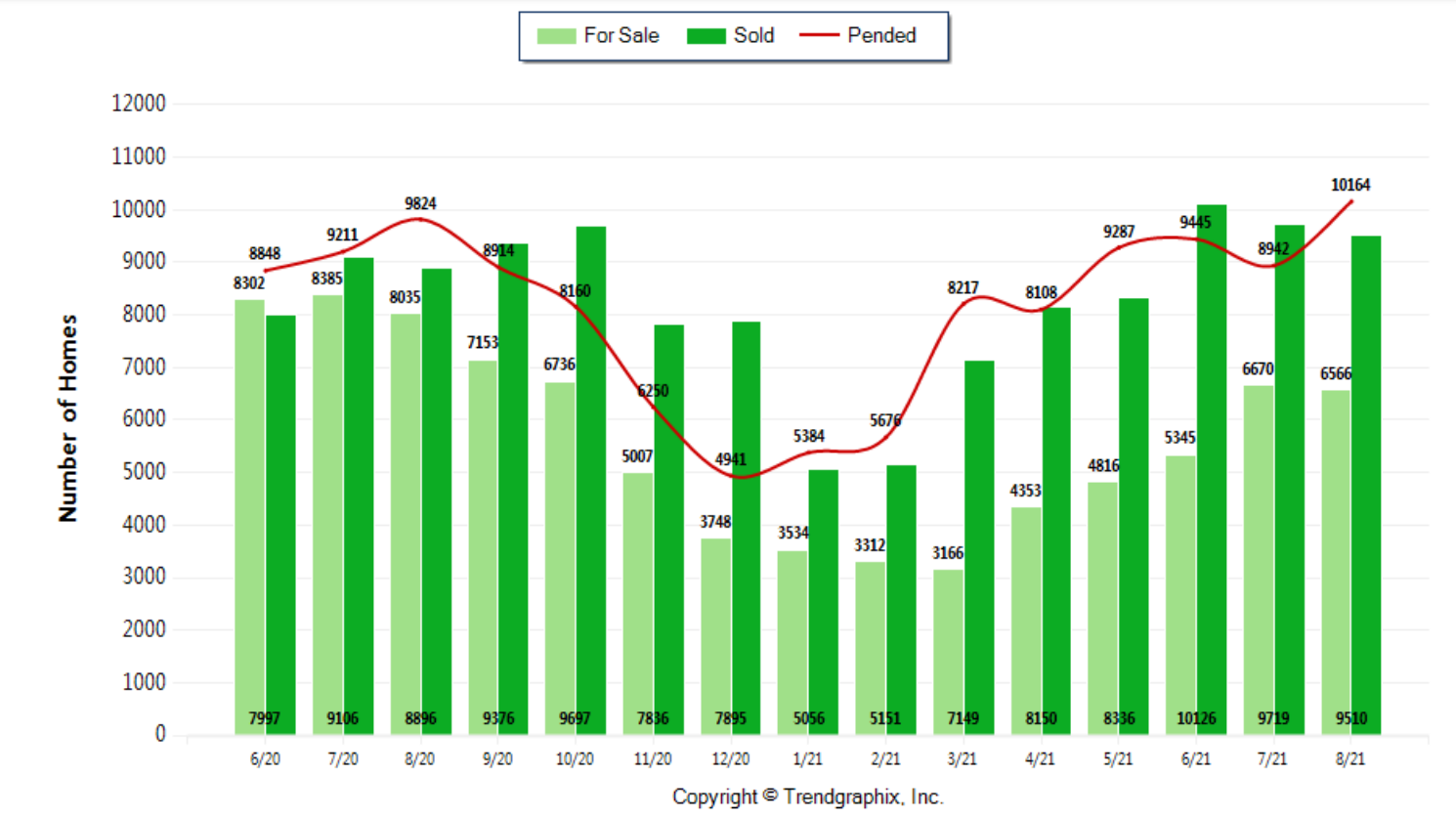

August 2021 is a Seller's market!

The number of for sale listings was down 18.3% from one year earlier and down 1.6% from the previous month. The number of sold listings increased 6.9% year over year and decreased 2.2% month over month. The number of under contract listings was up 13.7% compared to previous month and up 3.5% compared to previous year. The Months of Inventory based on Closed Sales is 0.7, down 22.1% from the previous year. The Average Sold Price per Square Footage was down 1.1% compared to previous month and up 23% compared to last year. The Median Sold Price decreased by 1.5% from last month.

The Average Sold Price also decreased by 1.8% from last month. Based on the 6 month trend, the Average Sold Price trend is "Neutral" andthe Median Sold Price trend is "Neutral".

The Average Days on Market showed a neutral trend, a decrease of 48.1% compared to previous year. The ratio of Sold Price vs. Original List Price is 94%, a decrease of 6% compared to previous year.

Property Sales (Sold)

August property sales were 9510, up 6.9% from 8896 in August of 2020 and 2.2% lower than the 9719 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 1469 units of 18.3%. This year's smaller inventory means that buyers who waitedto buy may have smaller selection to choose from. The number of currentinventory is down 1.6% compared to the previous month.

Property Under Contract (Pended)

There was an increase of 13.7% in the pended properties in August, with 10164 properties versus 8942 last month. This month's pended property sales were 3.5% higher than at this time last year.

August typically brings a dip in housing activity and this year was no different. Figures comparing July to August show month-to-month drops in new listings, total inventory, pending sales, close sales, and median prices.

August showed a more traditional seasonal pattern with decreased activity as families took end-of summer vacations and made back-to-school preparations.

Statistics show the volume of new listings added during August, including single family homes and condominiums, declined from both July (down 11.5%) and twelve months ago (down 4.2%). Total inventory for the 26 counties in the report also fell, shrinking about 6.6% from July and nearly 22.6% from a year ago. At month end, there were 7,425 active listings, down from the year-ago total of 9,591.

A dip i n open house traffic overall, although some new listings were overwhelmed with traffic, depending on the area and the price point. We are seeing homes stay on the market slightly longer and more instances of sellers overpricing their properties.

The continued lack of inventory indicates properties will move very quickly if priced reasonably. Even in our current hot market, pricing a property correctly has never been more important.

Prices showed signs of moderating during August. The median price on the 10,571 sales that closed last month was $579,000, a drop of $10,000 from July. Prices did rise compared to 12 months ago, climbing from $490,000 for an increase of about 18.2%. That year-over-year (YOY) percentage change was the smallest since February when there was a bump-up of about 15%.

A suggestion of price cooling is in sight. It is said to look at listing prices as a leading indicator of where things are headed. In King County, median list prices dropped from $740,000 in July to $729,000 in August. That would explain why the median sales price also fell modestly month-over-month. This is because we are hitting a price ceiling and that the rabid pace of home price appreciation will continue to cool as we move through the rest of the year.

Figures show the median list price system-wide for single family homes and condos combined, was unchanged, at $605,000, from July to August. The asking price fell from July to August in about half the counties in the report.

Purchasers are continuing to find mortgage interest rates below 3%, providing increased buying power. It is believed that the historic low interest rates coupled with lifestyle changes continue to be market drivers and factors in keeping inventory at historically low levels.

Figures indicate there was around three weeks of inventory (0.70 months) at the end of August. Clark, King, Kitsap, Lewis, Mason, Pierce, Snohomish, and Thurston counties had only about three weeks of inventory, with Snohomish reporting the smallest supply (0.49 months), about two weeks.

Gains in total active inventory in several counties were mostly consistent with patterns observed all year, notably in the suburbs, the seaside, and the Olympic Peninsula. It is not just a return to the suburbs, it is a continued return to the country as people continue to work from home. Several counties experienced year-over-year increases in inventory, including Chelan, Douglas, Ferry, Grays Harbor, Island, Kittitas, Lewis, Mason, Okanogan, and Thurston.

In about half the counties, the number of new listings outgained the number of pending sales. For all counties combined, last month’s total number pending sales (12,238) surpassed the number of new listings (11,437), a margin of 801 units. The extreme real estate market in the Puget Sound area continued during August, with strong buyer demand due to historically low interest rates and a backlog of buyers still looking for a home.

It is expected that the housing market intensity for each new listing will start tightening back up again in the Puget Sound region as we start heading toward the first of the year. Condos may be showing some signs of pent-up demand, noting closed sales were up more than 10% from a year ago, with King County sales jumping 19.9%. Not only is there pent-up demand as some choose to move back to the city center a year after civil unrest and a pandemic, but residential buyers are finding themselves priced out of the market and are moving toward condo ownership

While it is noted that the YOY uptick in condo sales, he said some buyers are still looking to move further away from the city and employment centers. Work from home opportunities, as well as the thought/hope that some employers will allow flexible work schedules post-COVID are driving factors, adding, other factors are lower taxes and overall costs in suburban areas. People are buying the maximum house they can and factoring in the variable cost of a commute. Many out-of-state buyers are not very concerned about distance from workplaces as they are accustomed to long commutes.

In Kitsap County, the market “continues to be very hot,” with inventory remaining low. Prices and interest rates are not going to stay stable for long.” He also noted rental rates continue to climb. It is expected that an influx of people will keep moving to the Kitsap Peninsula area, including 3,000 sailors and their families who arrived in late July when the aircraft carrier USS Theodore Roosevelt shifted its homeport from San Diego to Bremerton for a planned 16-month retrofit. Home values in Kitsap County, which rose 14.7% from a year ago, will keep increasing even as builders are trying to meet demand. Although there are affordable home options being planned for the future, those are several years away. Affordable housing has taken a real hit over the past six or seven years with the average price far exceeding what the average income in Kitsap can afford.

At the other end of the price spectrum, luxury home sales continue to exceed expectations, with no signs of slowing. According to statistics, nearly 15% of this year’s sales (through August) commanded prices of $1 million or more. The year-to-date total of 10,237 sales that have fetched $1 million-plus eclipses the totals for all of 2020 when there were 8,898 such sales, as well as the entire year of 2019, when members notched a total of 6,711 sales over a million dollars. An analysis found strong activity for luxury homes in Snohomish and Pierce counties, prompting him to say, this tells that there’s a migration of buyers who are choosing to move away from King County and into adjacent areas where their money goes further

Know the Top 5 Things You Need To Ask For When Getting Mortgage Rates.

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates.

For more Real Estate News and Advice, please tune in to our Facebook live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com